This post previously appeared in the Harvard Business Review.

This post previously appeared in the Harvard Business Review.

Three types of organizations – Incubators, Accelerators and Venture Studios – have emerged to reduce the risk of early-stage startup failure by helping teams find product/market fit and raise initial capital. Venture Studios are an “idea factory” with their own employees searching for product/market fit and a repeatable and scalable business model. They do the most to de-risk the early stages of a startup.

Outside a small university in the Midwest, I was having coffee with Carlos, a rising star inside a mid-sized manufacturing company. He had a track record of taking small teams and growing them into successful product lines. However, after a decade working for others, Carlos was interested in building and growing a company of his own. I asked how much he knew about how to get started. He said that from what he read, the path to building and funding a company seemed to be: 1) come up with an idea, 2) form a team, 3) start testing minimal viable products, 4) raise seed funding, 5) then obtain venture capital.

As he described his work in additive manufacturing and 3D printing, Carlos said he knew that there were seed investors in his town, but venture capital was still largely on the coasts, and it was hard to get their attention. He also wasn’t sure his idea was great. But he still had the itch to grow something small into a substantive company.

As we grabbed dessert, Carlos asked, “Other than raising money, are there other ways to start a company?”

I pointed out that there were.

Reducing Startup Risk

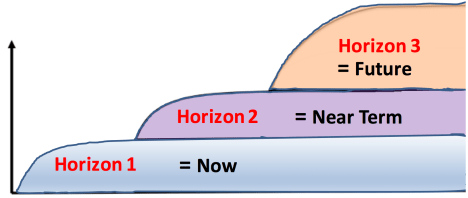

In the last two decades, three types of organizations — incubators, accelerators and venture studios — have emerged to reduce the risk of early-stage startup failure by helping teams find product/market fit and raise initial capital. Most are founded and run by experienced entrepreneurs that have previously built companies and who understand the difference between theory and practice.

I pointed out to Carlos that accelerators like Y-Combinator, Techstars, and 500 Startups offer a cohort of startups a six to 12-week bootcamp. But these look for founders who have a technical or business model insight and a team. Accelerators provide these teams with technical and business expertise and connect them to a network of other founders and advisors. The culmination of this bootcamp is a “demo day” where all startups in the cohort have a few minutes to pitch their companies to venture capitalists and angel investors. (In some cases the accelerator provides initial funding themselves.) In exchange for attending an accelerator, startups give up 5% to 10% of their company’s equity.

There are thousands of accelerators across the globe. The business model for most of these accelerators is to select startups that can generate venture-class returns – i.e. grow into companies that can potentially be worth billions of dollars. For most accelerators, admission is by application and interview. Some, like Y-Combinator, Techstars, and 500 Startups are open to all types of startups in any market, while others like SOSV, IndieBio, HAX, Orbit, dLab are more specialized.

Incubators are similar to accelerators in that they provide space and shared resources to startups, but usually no or very small amounts of capital. Their financial models are based on membership fees that grant access to a shared coworking space, resources, and access to other founders and operational expertise.

Carlos stirred his coffee. “Accelerators don’t sound like a fit for where I am at in my career,” he offered. “I don’t have a killer idea, or a technical team, but I do know how to build, grow, and manage teams.”

The Alternative: Venture Studios

I pointed out there were organizations that might be a better fit for his skills and passion to go out on his own — venture studios. Unlike an accelerator, a venture studio does not fund existing startups.

Venture studios create startups by incubating their own ideas or ideas from their partners. The studio’s internal team builds the minimal viable product, then validates an idea by finding product/market fit and early customers. If the idea passes a series of “Go/No Go” decisions based on milestones for customer discovery and validation, the studio recruits entrepreneurial founders to run and scale those startups. Examples of companies that have emerged from venture studios, include Overture, Twilio, bitly, aircalla, and the most famous alum, Moderna,

I suggested Carlos think of a venture studio as an “idea factory” with their own full-time employees engaged in searching for product/market fit and a repeatable and scalable business model.

How Venture Studios Work

Unlike an accelerator or incubator, a venture studio doesn’t fund existing startups. It’s a company that creates multiple startups in-house, then finds entrepreneurs who take them over to grow them.

Most venture studios create and launch several startups each year. These have a greater success rate than those that come out of accelerators or traditional venture-funded companies. That’s because unlike accelerators, which operate on a six- to 12-week cadence, studios don’t have a set timeframe. Instead, they search and pivot until product-market fit is found. Unlike an accelerator or a VC firm, a venture studio kills most of their ideas that can’t find traction and won’t launch a startup if they can’t find evidence that it can be a scalable and profitable company.

Comparing Startup Funding Options

Venture studios are a good fit for entrepreneurs who don’t have an idea or team but would like to run and grow a startup. The venture studio’s employees have already identified a product, market fit and early customers — meaning someone else has eliminated many of the early risks of a new venture. In return for the lower risk, a venture studio typically takes a larger percentage of equity.

There are four main types of venture studios:

- Tech transfer studios, such as America’s Frontier Fund, work with companies and/or government labs to source ideas and intellectual property. They then transfer the IP and build the startup inside the venture studio.

- Corporate studios, such as Applied Materials, source ideas and intellectual property inside their own company. They then build the startup inside a separate corporate venture studio inside the company.

- A niche studio is a standalone venture studio that generates its own ideas and IP in a specific industry and domain – for example Flagship Pioneering , which is focused on health care and incubated LS18 — the company that became Moderna.

- An industry agnostic studio, such as Rocket Internet, is a standalone venture studio that generates its own ideas and IP and is industry and market agnostic.

Today there are around 720+ venture studios across the world – half are in Europe. In both North America and Europe, many venture studios in non-major cities are funded by government agencies to stimulate local growth, at times with matching donations from companies. These studios have different metrics than startup studios whose limited partners are private family offices or venture capitalists.

Why Would an Entrepreneur Join a Venture Studio?

While we were on our second cup of coffee, I told Carlos about the downside to joining a company created by a venture studio — how much equity/ownership they take.

In contrast with an accelerator that takes 5%-10% of a startup’s equity, venture studios take anywhere from 30%-80% of a startup’s equity. This is because companies exiting a venture studios have been handed a startup that has de-risked of much of the early-stage startup process. (There’s a direct correlation between the amount of equity a venture studio takes and their belief in how much they want their founding CEO to be an entrepreneur versus executor.)

Why would an entrepreneur join a venture studio and give up the majority of their company rather than go to accelerator? Most accelerators tend to look for a “founder type” — a stereotypical techie, fresh out of college, who already has an idea and cofounders.

Most people don’t fit that pattern. Yet many are more than capable of taking an idea that’s been stress-tested and validated and building it.

What To Look for in a Venture Studio?

As we got up to leave Carlos asked, “How would I know whether the venture studio a good one?”

It was a great question. While there are no hard-and-fast rules, I advise entrepreneurs to ask these four questions:

- Is the studio run by a former founder and does it have former founders as full-time employees? The most successful venture studios are founded by entrepreneurs that have previously built companies with $10+M in revenue and had 100+ employees.

- What percentage of equity are they asking for? The answer will be directly proportional to what they think your value is. Firms asking for greater than 60% are actually hiring an employee rather than a founder.

- Do you want a studio with specific expertise? Studios that focus on specific niches and industries can build a deep bench of domain experts – e.g. founder, advisors, and mentors – who are experts in this one field

- Do they have enough funding? Watch out for Zombie studios. If you’ve given away a majority of your company to a studio, it would be helpful to have them around for support after you’ve started. If they don’t have enough funding to keep the lights on for several years, you’re on your own. Make sure your studio has raised more than $10m in funding.

A few weeks later I got a note from Carlos letting me know that he found that there was a venture studio in his city, another run by the state, and a third in his region focused on manufacturing. He had applied to all of them.

Filed under: Harvard Business Review, Venture Capital | 6 Comments »

This article previously

This article previously  This article previously appeared

This article previously appeared