Not understanding and agreeing what “Entrepreneur” and “Startup” mean can sink an entire country’s entrepreneurial ecosystem.

———

I’m getting ready to go overseas to teach, and I’ve spent the last week reviewing several countries’ ambitious attempts to kick-start entrepreneurship. After poring through stacks of reports, white papers and position papers, I’ve come to a couple of conclusions.

1) They sure killed a ton of trees

2) With one noticeable exception, governmental entrepreneurship policies and initiatives appear to be less than optimal, with capital deployed inefficiently (read “They would have done better throwing the money in the street.”) Why? Because they haven’t defined the basics:

What’s a startup? Who’s an entrepreneur? How do the ecosystems differ for each one? What’s the role of public versus private funding?

Six Types of Startups – Pick One

There are six distinct organizational paths for entrepreneurs: lifestyle business, small business, scalable startup, buyable startup, large company, and social entrepreneur. All of the individuals who start these organizations are “entrepreneurs” yet not understanding their differences screws up public policy because the ecosystem in supporting each type is radically different.

For policy makers, the first order of business is to methodically think through which of these entrepreneurial paths they want to help and grow.

Lifestyle Startups: Work to Live their Passion

On the California coast where I live, we see lifestyle entrepreneurs like surfers and divers who own small surf or dive shop or teach surfing and diving lessons to pay the bills so they can surf and dive some more. A lifestyle entrepreneur is living the life they love, works for no one but themselves, while pursuing their personal passion. In Silicon Valley the equivalent is the journeyman coder or web designer who loves the technology, and takes coding and U/I jobs because it’s a passion.

Small Business Startups: Work to Feed the Family

Today, the overwhelming number of entrepreneurs and startups in the United States are still small businesses. There are 5.7 million small businesses in the U.S. They make up 99.7% of all companies and employ 50% of all non-governmental workers.

Small businesses are grocery stores, hairdressers, consultants, travel agents, Internet commerce storefronts, carpenters, plumbers, electricians, etc. They are anyone who runs his/her own business.

They work as hard as any Silicon Valley entrepreneur. They hire local employees or family. Most are barely profitable. Small business entrepreneurship is not designed for scale, the owners want to own their own business and “feed the family.” The only capital available to them is their own savings, bank and small business loans and what they can borrow from relatives. Small business entrepreneurs don’t become billionaires and (not coincidentally) don’t make many appearances on magazine covers. But in sheer numbers, they are infinitely more representative of “entrepreneurship” than entrepreneurs in other categories—and their enterprises create local jobs.

Scalable Startups: Born to Be Big

Scalable startups are what Silicon Valley entrepreneurs and their venture investors aspire to build. Google, Skype, Facebook, Twitter are just the latest examples. From day one, the founders believe that their vision can change the world. Unlike small business entrepreneurs, their interest is not in earning a living but rather in creating equity in a company that eventually will become publicly traded or acquired, generating a multi-million-dollar payoff.

Scalable startups require risk capital to fund their search for a business model, and they attract investment from equally crazy financial investors – venture capitalists. They hire the best and the brightest. Their job is to search for a repeatable and scalable business model. When they find it, their focus on scale requires even more venture capital to fuel rapid expansion.

Scalable startups tend to group together in innovation clusters (Silicon Valley, Shanghai, New York, Boston, Israel, etc.) They make up a small percentage of the six types of startups, but because of the outsize returns, attract all the risk capital (and press.)

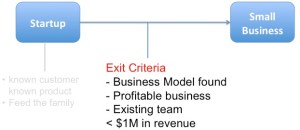

Just in the last few years we’ve come to see that we had been building scalable startups inefficiently. Investors (and educators) treated startups as smaller versions of large companies. We now understand that’s just not true. While large companies execute known business models, startups are temporary organizations designed to search for a scalable and repeatable business model.

This insight has begun to change how we teach entrepreneurship, incubate startups and fund them.

Buyable Startups: Born to Flip

In the last five years, web and mobile app startups that are founded to be sold to larger companies have become popular. The plummeting cost required to build a product, the radically reduced time to bring a product to market and the availability of angel capital willing to invest less than a traditional VCs– $100K – $1M versus $4M on up – has allowed these companies to proliferate – and their investors to make money. Their goal is not to build a billion dollar business, but to be sold to a larger company for $5-$50M.

Large Company Startups: Innovate or Evaporate

Large companies have finite life cycles. And over the last decade those cycles have grown shorter. Most grow through sustaining innovation, offering new products that are variants around their core products. Changes in customer tastes, new technologies, legislation, new competitors, etc. can create pressure for more disruptive innovation – requiring large companies to create entirely new products sold to new customers in new markets. (i.e. Google and Android.) Existing companies do this by either acquiring innovative companies (see Buyable Startups above) or attempting to build a disruptive product internally. Ironically, large company size and culture make disruptive innovation extremely difficult to execute.

Social Startups: Driven to Make a Difference

Social entrepreneurs are no less ambitious, passionate, or driven to make an impact than any other type of founder. But unlike scalable startups, their goal is to make the world a better place, not to take market share or to create to wealth for the founders. They may be organized as a nonprofit, a for-profit, or hybrid.

So What?

When I read policy papers by government organizations trying to replicate the lessons from the valley, I’m struck how they seem to miss some basic lessons.

- Each of these six very different startups requires very different ecosystems, unique educational tools, economic incentives (tax breaks, paperwork/regulation reduction, incentives), incubators and risk capital.

- Regions building a cluster around scalable startups fail to understand that a government agency simply giving money to entrepreneurs who want it is an exercise in failure. It is not a “jobs program” for the local populace. Any attempt to make it so dooms it to failure.

- A scalable startup ecosystems is the ultimate capitalist exercise. It is not an exercise in “fairness” or patronage. While it’s a meritocracy, it takes equal parts of risk, greed, vision and obscene financial returns. And those can only thrive in a regional or national culture that supports an equal mix of all those.

- Building an scalable startup innovation cluster requires an ecosystem of private not government-run incubators and venture capital firms, outward-facing universities, and a rigorous startup selection process.

- Any government that starts public financing entrepreneurship better have a plan to get out of it by building a private VC industry. If they’re still publically funding startups after five to ten years they’ve failed.

To date, Israel is only country that has engineered a successful entrepreneurship cluster from the ground up. It’s Yozma program kick-started a private venture capital industry with government funds, (emulating the U.S. lesson of using SBIC funds.), but then the government got out of the way.

In addition, the Israeli government originally funded 23 early stage incubators but turned them over to the VC’s to own and manage. They’re run by business professionals (not real-estate managers looking to rent out excess office space) and entry is not for life-style entrepreneurs, but is a bootcamp for VC funding.

Unless the people who actually make policy understand the difference between the types of startups and the ecosystem necessary to support their growth, the chance that any government policies will have a substantive effect on innovation, jobs or the gross domestic product is low.

Listen to the post here: Download the Podcast here

Filed under: Business Model versus Business Plan, Corporate/Gov't Innovation, Teaching, Technology, Venture Capital |

Some helpful definitions here Steve, though as ever there can be some greying around some boundaries. Here in the UK HE educators do a lot of self help (See: http://www.enterprise.ac.uk) and those who cross boundaries into the ‘real world’ often do so at their own risk. Its a very frail eco-structure indeed.

Student motivational aspects are key – so your definitions could prove very helpful in that respect too – not just for governments!

We have not been very tolerant of governments and politicians with tough messages. Lifestyle and small businesses account for most of the entrepreneurs and businesses in the economy – and thus most of the votes from this block. They are also local and visible to other voters.

But scalable businesses disproportionately contribute to new job creation – what every politician says they want to support. (See http://bit.ly/pe8zt4 from Kauffman and http://archive.sba.gov/advo/research/rs328tot.pdf from the SBA for example.)

One group gets votes, one might have a better chance of getting results. But those results probably won’t be visible within our election cycles.

It is on us to educate politicians, to speak up for investment choices supporting an environment for scalable companies, to cast our votes well, and to encourage others to do the same.

We get what we elect and what we speak out for.

Steve a very interesting post found via Hacker News. Just wondering what other countries’ plans for entrepreneurship you looked at?

Your point is well taken about the different types of entrepreneurs. Many developing countries are filled with entrepreneurs who run very small scale businesses. So the problem in my mind isn’t entrepreneurship on the whole, but giving the access to resources that would allow these small businesses to grow.

There’s a smiley face on your page that i can’t stop staring at.

Yujean,

It’s the WordPress tracking beacon they put on every blog page to count site stats.

steve

Hi Steve,

What a great article! I agree on how you have classified startups. We generally just talk about one type of startup, but as you say, there are characteristics for each one. This is a complex (and debatable) topic, but this introduction will surely guide people.

You’ve advised the government program Startup Chile, so which category does it fall under? They have “no plan to get out of it by building a private VC industry.” You say, “If they’re still publicly funding startups after five to ten years they’ve failed.” Well, Chile is running the program for only 3 years without a plan to attract private capital, so is that doomed to failure?

I reckon that Startup Chile is failing not only because it is not attracting private capital, but also because it is attracting lifestyle businesses rather than scalable startups:

http://brophyworld.com/start-up-chile-enticing/

Hi Steve,

That’ s an amazing post. That’s the first time I hear about these 6 types of startups so clearly defined, despite a degree from a Business School.

I think it’s not only governments that we have to better educate about this dichotomy of entrepreneurs.

Hi Steve,

Timely post, especially the scalable startups portion as it relates to today’s announcement that Silicon Valley based Solyndrs filed for bankruptcy after receiving over $ 500 million in federal loan guarantees. I believe this guarantee induced a false sense of security and premature scaling (re your post earler this week).

Prior to the loan guarantee, one of Solyndra’s major self selling points was how ‘hi-tech’ their manufacturing plants were and how they could be operated with less than ten people.

The loan guarantee and the associated ‘lob creator’ hunbris literally corrupted their business model. With today’s announcement came word that 1100 people will be laid off. What were all these people doing?

The future will no doubt bring case studies of Solyndra’s failure. I wonder how many of your salient points will be included?

One final point. Much of Solyndra’s initial promise was based on a back log of orders to European contracts supported by various government guarantees for feed-in-tariff financing. This financing was substantially restructured with the economic crisis. Contracts were cancelled. As it has been said, “the rest is history”.

This situation is very similar to the demise of the solar industry here in the States nearly 30 years ago and could well advance an article entitled, ” Why startups should not get Government”.

If Solyndra were a private investment, I think the investors also might have checked on it occasionally. They ask hard questions. They’d force a change in strategy.

It would be “Ok, this is sucking. Return our money.”, not “Oops. Money all gone. Bye, bye” and “But at least stuff was stimulated.”

Government is the place where ideas that don’t work go live on and on and on. All it takes is a theory. No experiments are required. No one has ever proven stimulus works, for example. It just has sound convincing and promising if you ignore half of the evidence.

Private investors lost a lot more than the government (over $1.1 billion).

You are right Steve, about the premature scaling by Solyndra.

This fiasco would not have occurred had DOE advisors and decision makers heeded your advice in your Epiphany book.

In the end it was doomed when the promise/belief of large scale manufacturing and thousands of jobs took hold. It was a politically motivated event! –at taxpayers’ expense. (VCs may recoup part of their investment if Chinese would buy the technology and IP)

Government does not innovate well. And it can’t.

Government is use of force. You can’t force customers to deal with you. You have to listen, not dictate. Not if you want to learn about real needs and discover whats crap about your product.

You have to experiment and kill off what doesn’t work, not keep things alive because of who might take offense and not vote for you.

Often, you have to discover what their needs are before they realize what they are.

You have to have a very real stake in a thing and care for it passionately if you’re going to the hell that is often required to give birth. You can’t move off to the next popular issue when your attention span runs out.

And you can just fund things because they sound cool to the media, or because its sound bite worthy.

In short, government is all wrong for this task. One only need to look at what it takes to deal with the government any time there is an exception to a process. Its a nightmare.

Well, real entrepreneurship is ALL exceptions. Its not for the 9 to 5, “push out that deadline whenever its convenient” crowd.

Come on. They can’t even adapt to the drop in mail volume without an act of Congress.

What about tekes?

Paul,

What about it?

steve

TEKES is a Finnish government funding program. You might actually get some info about it and its results on this trip.

Government is an interesting animal. It does not generally produce anything of value, it can merely manage or fill in administrative gaps in a mature market that needs to create busywork for the populace. Unfortunately, elected officials and government itself seem to have written off a large chunk of the population and just throw survival subsidies at them. Anyhow, I really appreciate the breakdown of these six types, because it helps one figure out which type is closest to their business model and how to properly feed it.

This does not really state why governments don’t get startups. Based on the post comments, probably most entrepreneurs (and everybody else) don’t get startups. I’d venture to say that most startups fail because they don’t know which startup they even are. The other thing that strikes me as illogical about this post is that one can only bucket a startup after it has evolved to a steady state….a startup may be “scalable” in nature at the beginning, but fail into a lifestyle business over months/years. However, I do like the academics of categorizing startups.

Steve,

What countries did you review apart from Israel? I’ll be writing a blog post, this weekend, on what’s been happening here in the UK. I agree with you that “Governments don’t get startups”, in general. However, I don’t think that a main reason is that they don’t understand the different type of startups. As with startups it’s the execution that sucks, well here anyway.

More to follow and thanks for and interesting post.

Colin

Meant to say “As with startups, that fail, it’s the execution that sucks, well here anyway.”

Colin, please make that blog post available here as well as what is happening in the UK now will surely be a model for stripped down centralized government worldwide.

As we move toward a more scientific approach to entrepreneurship, taxonomy is important – it’s the foundation of any science. Your distinctions of the different kinds of startups are absolutely critical to building any infrastructure. I like how your list is expanding – it used to be 4 now it’s up to 6.

I have 2 comments about this approach.

One is I think there’s a kind of business that’s missing from your list. What I call the “legacy” business. It’s kind of like what you call the “feed the family” biz but super-sized. Sometimes it happens by circumstance, but some are actually started with the purpose of getting big, but not “change the world big” or IPO big. If you read “The Millionaire Next Door” – written back when 5 or 10Million was considered “high net worth” they found that 2/3 of high net worth individuals owned “boring” companies like construction companies, bowling alleys, cement plants. These could feed the family for generations. Maybe “boring” is the other type. I do think there’s another kind somewhere. I’m not sure where it fits exactly, and that brings me to my second point.

Your criteria for classification seems to vary. In some cases the distinguishing factor is revenue, sometimes number of employees, and sometimes exit strategy. I suspect there’s a single structure that could be used to classify all companies as there is in biology (with Kingdom / phylum etc down to species), and my guess is that structure could be found somewhere in the business model and/or lifecycle of a business. In my mind a business model is formed from a tension between internal “stuff” (vision, skills, abilities, motivation) and external constraints (the market, technology, even regulation) I’m guessing the most useful taxonomy is found in that tension.

Great to see this stuff evolving so fast. Keep up the good work, and thanks for sharing it so publicly.

These legacy businesses are getting fewer and fewer in number, and so while it is missing, I think maybe this is deliberate. My family has a few of these legacy businesses and if I strictly look at evidence, I think a lot of this capital shall be lost in the near term because no one is mentally equipped to maintain them, and the markets have changed so much. The era of low-ball millionaires (in today’s real terms) peaked in the 1960s and 1970s and has probably been hacked away at by 75% since the 1990s.

In the tech Start-up scene, there are two interesting sub-categories. Too often we meet guys who have invented “the coolest solution in the world” – and then spend years trying to figure out a suitable problem to the fancy solution. Examples are many, but I don’t want to embarrass those hard-working guys.

The other category start from understanding well an industry and identifying a huge, so far unresolved problem. In many cases finding the solution requires lots of cross-disciplinary creativity and a team to combine functional business skills, understanding of a bunch of tools and technologies and, last, but not least team skills to work together, challenging, but respecting each other.

Look at the Finnish companies like Eniram (marine business, control systems, sensors, statistics…), 7signal (WLAN, hospitals, SLA, QA) or iBriQ (construction, architecture, CAD, robotics – and bricks). Those are the ones that can really challenge the world with disruptive solutions to real problems worth solving.

Thanks for the clear classifications of the different types of startups. Our experience working with startups in the Southeast confirms both your categories and the importance of the government getting out of the way! We spend a lot of time helping starters figure out what track they are on, as they will invariably consider themselves to be the next big thing, even if they are really a lifestyle business. We typically help them self-classify into the right “category” by explaining angel/VC investment terms…

By the way, in response to the comment of Startup Chile, I was just talking with one of the current participants, and he found a large part of the value to be in the way the government did not try to get involved, but just gave them money and left them to themselves. Of course, the lack of mentorship and investor connections is a negative, but they are finding the hands off attitude of the Chilean government to be a welcome surprise, allowing real innovation to take place among the transplant community of entrepreneurs there.

My question for you is this: Do you find the Startup America program to be an example of the government correctly allowing the private sector to determine the structure and categorizations for best helping and connecting entrepreneurs with relevant resources, or do you find it to be another example of government created irrelevance?

Our experience with StartupTN has been great, and one fo my best experiences with government affiliated programs, but our state’s program is being headed up by a very competent leader from within the successful startup community who “gets it”. I’d love to hear your thoughts, though I guess you might have your reasons for leaving out any mention of the Startup America in your post.

I think of locales as having import/export economies. Import of goods and services into a locale causes outflow of funds, and export of goods or services results in inflow of funds. Some local activities are import/export neutral, but in many cases local activities that at first glance seem neutral are actually elements of the support chain for import activities. A grocery store, for instance, enables import of foodstuffs etc. from many places external to the locale. Import activities greatly add to the quality of life in most locales…but they have to be paid for.

From that perspective, any job must be supported by the locale’s net income, and job creation ultimately requires either growth in private income or some sort of government funding, i.e. transfer from outside the locale, or perhaps borrowing. Thus the ultimate goal of government support of business formation should be creation of export activities. Import activities need no support; they’re demand driven. They’ll always self-fund to arise and grow, as soon as enough export provided funds are available locally to be spent on those additional imports.

Lifestyle businesses are neutral or import-supporters.

Small businesses are usually importers or import-supporters. Occasionally a small business is a manufacturer that sells outside their local area, thus is an exporter, but this is unusual.

Social startups could be exporters, but usually they’re not. Sometimes when they’re exporters, they don’t in fact make a sustainable positive contribution to net locale income because they’re dependent on some kind of governmental transfer funding that will end.

Large companies have already established their credentials as to locale-export ability, so from this perspective their new-export-innovative efforts can be worthy of government support.

Buyable and scalable startups are where most growth in locale-export comes from. They may not seem to create many jobs initially, or at least not jobs that the local population sees as relevant to most job seekers…but ultimately the goal of the locale’s economic developers should be to build export activities, because that’s the only way to increase the locale’s net income, and that’s the best way to support jobs.

It’s essential that economic development efforts *not* be focused on strengthening or maintaining businesses that are in fact importers or import-supporters. Those businesses, however worthy their owners and employees and however appreciated their contributions to the local quality of life, ultimately subtract from the locale’s net income. This can be very difficult politically because it conflicts with democratization of employment availability, but it’s essential to understand in order for economic development activities to not be strategically self-defeating.

I’m glad to see Entrepreneurship Taxonomy 1.0, something I’ve been thinking about as well. It’s a step towards recognizing that Silicon Valley is atypical and not widely replicable.

IMO, the description of Scalable Startups needs some work. I’ve called it Scalable Innovation, as the companies are offering something the market hasn’t seen before (or there hasn’t been a market per se). But “big” in Silicon Valley is different from “big” in Maine (where I am). And venture capital isn’t always necessary. A VC-backed $10 million profitable niche software company is a loser in Silicon Valley; a bootstrapped $10 million profitable niche software company is a hero in Maine (sez a former top tier VC now in Maine).

To John Seiffer’s point, there are Scalable businesses that aren’t innovations. My grandfather built the largest non-union roofing company in eastern Pennsylvania, allowing my uncle and hundreds of employees to have a great living. Scalability here is more due to execution excellence than the type of underlying market opportunity.

The usefulness of considering Innovation in the taxonomy relates to capitalization. With it, debt financing is usually impossible – you need equity or bootstrapping – but there are Scalable non-Innovation companies that banks love.

And then… Large Company Startups. If a fundamental premise is that (Innovation) Startups are in search of a new business model, then I’d narrow the definition to those where that’s the case. Not all acquisitions are in search of a business model, nor are all new divisions, but some are, especially in the case of disruptive technologies.

Another take at a taxonomy is considering which of the following elements is driving the founding entrepreneur(s):

Vision

Skills

Income

Wealth

Lifestyle

A different relative proportion of each factor drives different types of startups in the taxonomy.

Steve

I found this post and the comments very interesting. I managed an incubation centre in Ireland for four years and now consult with startups. Our Enterprise Agencies have a strong focus on what we call High Potential Start Ups (HPSUs) which would fit into the Scalable Startups but may end up as legacy businesses as described by John Seiffer or possibly Buyable Startups. I am looking forward to your comments on how the best in the business classify startups at the early startup stage into the various categories as per the comment from Don Gooding.

regards

Donnchadh (Irish name for Denis)

Perhaps govt programs would be more effective if they had even more explicit data on these different entrepreneur “constituencies”.

I just read this article where LinkedIn data analysts sliced and diced their data treasure trove to get some easily graspable entrepreneur characteristics: http://www.pcworld.com/businesscenter/article/239324/what_makes_an_entrepreneur_linkedin_data_offers_a_clue.html

Perhaps slicing that same data into those six entrepreneurial types and presenting each as a unique demographic would help tailor kickstarting programs to those demographics?

Good article, add in the fact that most governments only talk about wanting to help small businesses rather than actually doing it.

Take the need for finance as a prime example – the UK Govt (and the banks) talk about lending and how they are – but they don’t. The benchmark is set too high, meaning many businesses fail to get the funding they need.

I also used to believe Yozma is the best example of govt interference around to the point I advised Russian govt to base their VC progrma on it verbatim. Interesting that many years after the Russian program went into being the Israeli entrepreneurs with whom I happened to discuss Yozma claimed that you cannot get funded from funds that benefited from Yozma unless you are a partner’s buddy, and most funds that lead the funding scene in Israel have nothing to do with Yozma. Not sure if this is true or not but it seems like things are not as straightforward as they seem.

BTW if you have a kindle get Boulevard of Broken Dreams by Josh Lerner of Harvard. It examines dozens of govt innovation programs in the US and worldwide. Nice reading and plethora of facts.

Steve

Your classification of entrepreneurs are right on the money. However as an INC 500 entrepreneur I could not fit neatly into any of the categories you listed. My first ventures is a stable IT services firm that has provided employment to several 100 people over the past 5 years. It is well beyond the “Feed the Family stage” (never was intended to be that anyway) and I have no desire to scale up or flip. I know there are many such in the INC 5000 list that are in the 5 to 50 M revenue range that employs large numbers of people. Perhaps we should have a new category for a company that had the capability to “TRANSITION” from one stage to another as they see and act upon unforeseen opportunities. The progress of firms such as this will depend on the opportunities that are out there, the life stage of the entrepreneur, capital, and the capabilities of the team to execute.

The other issues that is critical as far as Governments are concerned is the basic definition of the term ‘Entrepreneurship’ itself. There is lack of coherence in this resulting in research and investment dollars meant for high-growth entrepreneurship being funneled to large established firms and or small Mom and Pop businesses that may never hire a third employee. While I am for a liberal definition of entrepreneurship, I feel classification is key for good policy. Questions like “Is a franchise truly entrepreneurial?” have to be answered. From a Policy prespective the focus has to be primarily on high-growth firms that creates maximum number of jobs for a given investment.

Your thoughts?

Regards

Dr Suresh Kumar

Founder, Green Earth LLC

Regarding your example-question, franchises almost always are locale-importers or import-supporters. As such, there is no economic justification for governmental support in any case, because the market suitably supports that number of importers for which there is sufficient demand through its purchases.

Governments must understand who is a locale-exporter if their support-decisions are to make strategic sense.

[…] an extremely influential entrepreneurial thinker and teacher, made this post on September 1st: Why Governments Don’t Get Startups. Steve has made some interesting points, detailed below, but I think he has missed some other […]

A ton of trees = about half a tree

Probably less if you count the roots.

Hi Sandie.

Great article. I agree that entrepreneurship needs to be better understood and carefully nurtured. All the best teaching.

not just by policy makers but also by the entrepreneurs themselves!

[…] giorni fa stavo leggendo questo post di Steve Blank che contiene una classificazione interessante delle startup, da lui suddivise in 6 […]

Great blog, thank you. I am preparing a new IT entrepreneurs course for my students in the Czech Republic. I wrote an introductory blog: What is the best startup type for students? http://jsedivy.blogspot.com/ I am listing another startup type – micropreneur, which probably belongs to life style category. There are also special kind of startups making a lot of money on governmental contracts or EU grants in my country.

The INOVAR program in Brazil has been relatively successful in fostering and mobilizing financing for tech-linked entrepreneurship. One of the few programs I am aware of that helps entrepreneurs and new fund managers, while also educating institutional investors. Brazil also has one of the most dynamic business incubator ‘systems’ that I’ve run across. Governments can find a useful role to play in supporting entrepreneurs…but they rarely manage to do so!

I would also invest Brazilian if I had large seed money quantities available. They are trying to curb inflation and interest rates now by discouraging foreign investment in some of those high yielding accounts, but overall, this is the most robust place in the world now, except for perhaps Turkey in the near future.

Do trees have rights? If so, they need a born to be big scalable startup asap.

[…] A great article about startup and entrepreuneurs. I define myself as “Lifestyle Startup“ […]

[…] and read Why Governments Don’t Get Startups. It’s a timely primer on the six types of startups and how each require a different ecosystem […]

Steve please read this, its a Novel idea on how Governments and Democracies should fund and allow Entrepreneurship to grow.

http://antagonistikotita.blogspot.com/2011/09/is-it-right-to-give-equal-chances-to.html

http://bit.ly/q6WolG

98% of this is right on. My only disagreement is with the last bullet point…a successful government-funded seed stage investing program in scalable start-ups does not necessarily need to be replaced by private investment community in 5-10 years… or be declared a failure. The two can co-exist and both benefit. Our personal experience with Ben Franklin Technology Partners is that the vast majority of angel deals done in Pennsylvania are investments in Ben Franklin seeded companies. This is more important today than ever given the low level of activity by investors in our region. Fortunately, we’ve developed a rigorous screening process that is focused on investing in potentially scaleable companies in a wide, wide range of technology types.

I mean someone has to prime the pump in businesses other than solar panels and social media. If you build a rigorous, business-focused screening process like we have, government funding of scalable start ups can be a huge win. We’ve got the results to prove it after almost 30 years.

Steve,

By meeting in person, Mr. Erlich Yigal of Yozma in Athens, he told me different things about the early days… and for today… Yes they build from scratch and after 10 years handed over incubators, but they still pay 250K$ on each for running expenses and they still fund with 80% grands early stage start-ups… also what I have learned from Israeli friends unknown to Mr Yigal about how these VC’s work, is that it takes a lot of “connections” to enter the party…

Our world is not perfect…

Also regarding Governments… they have two things that private sector will never have and one that can work as base. They care about the common good and they have huge money available for job creation programs… And the one thing that can work as a base is, they can manage and execute simple tasks…

Take these three ingredients, add a mechanism that handles blindly the whole process, combine it with Crowd Sourcing, Internet and add all community available (private and public) resources… add the skills of entrepreneurs, volunteers mentors and business developers… make capital irrelevant… and that’s iDea Framework… a bio-mimetic entrepreneurial ecosystem that looks like a big innovation game… in which all can play a role and all can create value within… more on iDea: http://bit.ly/q6WolG

Interesting points on enreprenuership Steve…

However, Israel’s incubation system isnt that amazing as you describe these days due to lack of funding in the open market in past years…

Still, I agree, there is so much Govs can do….

Sharon Weshler

Israel

Great post, Steve, and particularly timely for me. I’m a graduate student at the Fletcher School (one of feeder schools for folks heading in to leadership positions in government, particularly foreign policy), and I’m surrounded by people who will be making policy in the next 5 to 50 years…but many (most) of them sure don’t get startups.

A quick anecdote:

I read this post this morning about twenty minutes before a group meeting for an entrepreneurial marketing course I’m taking (Fletcher has an international business degree as well). The group was kicking around ideas for a startup in advance of pitching a first round of ideas to the class. Ideas proposed included: an import business selling handicrafts made in rural Ecuador to the US market and a new restaurant that specialized in “good” (tasty) ethnic foods, with a rotating cast of chefs. The enthusiasm within the group for these and similar ideas shocked me – and reinforced this post. The meeting broke up when two of my team members had to go submit Presidential Management Fellowship applications (the PMF is the flagship leadership development program advanced degree candidates looking to enter the US government).

I’d love to hear your thoughts on how to help these future leaders “get” startups and entrepreneurship. If students heading in to government have such a limited view of startups, I’m extremely pessimistic about future prospects for government-backed entrepreneurial activity. I’m equally pessimistic about the prospects for entrepreneurial thinking within government. So – how can we help?

[…] SCALEit mentor, Steve Blank, wrote this fine piece on ‘Why Governments don’t understand startups‘. We (of course) think we do – which is why we also now have Steve Blank as a part of […]

This breaks down the type of startups beautifully. The path is clear once you know what you are and then where you go is much easier to vision. As always Steve, you have proved that nobody else knows this stuff better than you.

You said the core thing that needs to be said about government, the only thing that they really need to do is create an environment for growth (tax, regulation, culture friendly)

Then GET OUT OF THE WAY

The problem with many governments, ours included, is that a large portion of their political investment belongs in bureaucracies, and getting out of the way shrinks those, and secondarily instead of promoting success (profit) they vilify it.

Until the target country gets a truly pro-business government they can dump all the money down the rat hole they want, it will never work

Todd,

I have to disagree that the best government can do is get out of the way.

I think you’ll find that many of the green technologies where other countries (China and to some extent Germany) are beating the US is a result of direct government intervention and support of commercialization of technologies in those countries. The irony is that many of those technologies were invented in the US but the American government either “got out of the way” or actively supported older petroleum based technology.

In another example, government decisions about if, when and where to build roads, rail and other infrastructure has a direct effect on how (or if) entrepreneurship develops in a given area.

Let’s not forget that active government intervention, research and money developed what is now the internet as well as a lot of the industry around Boston in the 1940’s and Silicon Valley in the 60’s and beyond.

There has also been research to show that industrial hubs develop in certain areas not only because of natural phenomena (geography, mineral deposits etc) but also because of other more arbitrary forces – some of which are funded by government.

This is not to say that everything government does works; but I think Steve’s point is that without a clear understanding of the different types of entrepreneurs and companies, it’s less likely that government action will yield the desired results.

John, indeed, Governments and actually using our own money (Taxes), can be used to change the whole start-up story for the best giving real equal opportunities to innovate for all, changing the coarse of capitalism towards a better world through entrepreneurship… If we little bit think out of the box. The problem Steve is seeing is real, current Gov interventions might be good some times but they create corruption also… so we need something NEW… In the devastated Greece we have work for 2 years to develop a new model that combines the US way and the Gov way, creating what we call, Participatory Entrepreneurial Assessment, Funding and Assisting. Read here for more info http://bit.ly/mTZbGw

Steve,

I am interested in teaching opportunities overseas. Can you forward advise as to were to get more information?

Kindest regards,

Gary Bronga

President, CLIPEZE Worldwide, Inc

Nice summary of the issue. A few years ago a friend who is a successful entrepreneur. The city wanted him to run an incubator as our venture catalyst group had had some nice successes. It quickly became apparent that the city wanted successes but not too successful, and did not want any to fail. Until government understands that some need to fail for others to succeed, their involvement will usually be a negative.

[…] Pas vraiment. Mon collègue Pascal (merci ) vient de me signaler un nouvel article de Steve Blank, Why Governments Don’t Get Startups, qui donne une excellente définition du […]

[…] right? Not so. Thanks to my colleague Pascal :-), I just read another article by Steve Blank, Why Governments Don’t Get Startups, who gives the perfect […]

[…] entrepreneur Steve Blank points out, there are six types of startup and only two of them; the scalable and buyable (born to flip) are suited to the Silicon Valley […]

[…] and entrepreneurship professor Steve Blank divides startups into six categories, spanning the range from small family businesses to internal corporate startups. I extract from his […]

[…] an extremely influential entrepreneurial thinker and teacher, made this post on September 1st: Why Governments Don’t Get Startups. Steve has made some interesting points, detailed below, but I think he has missed some other […]

[…] you Steve for identifying six distinct organizational paths for entrepreneurs: lifestyle business, small business, scalable startup, buyable startup, large company, and social […]

[…] an extremely influential entrepreneurial thinker and teacher, made this post on September 1st: Why Governments Don’t Get Startups. Steve has made some interesting points, detailed below, but I think he has missed some other […]

Personally found this article, and the posts very insightful. Busy with 3 start-ups in different categories, thus will employing the expressions, notes and comments in my work will go a long way in preventing unnecessary mistakes. Many thanks to Steve, as well as those who have commented.

Please don’t give up on us, you are doing well helping NSF grant awardees on starting up….

As an early immigrant to America, and a technical entrepreneur,

I suggest America needs these change drivers –to boost the

innovation edge America have over the developing regions of the

world. Every year the rest of the world graduate 5 to 10X more science

and engineering student than America, they are performing the more

mundane tasks than our workers at a fraction of our wages.

This trend is continuing:

1. Revamp our patent systems to enable individual–citizen inventors,

or very small startups to apply, at a low fee plan; to apply for

patents without having to hire patent lawyers who use arcane

language.

2. Expand innovation and research programs like SBIR’s to assist the

real startup entrepreneurs –small teams of entrepreneurs, up to

5 persons; rather than the 500-employees limit for small business.

[…] Work to Live their Passion’ that so accurately described the Master Steve Blank in his post here. Prizes awarded were to a local reseller of a Mobile Telecom carrier, a hairstyle salon and others […]

[…] to Take Money From? First, decide what type of startup you are. If you’re a lifestyle entrepreneur or a small business, odds are the return you can […]

[…] decide what type of startup you are. If you’re a lifestyle entrepreneur or a small business, odds are the return you can […]

[…] Scalable startups are on a trajectory for a billion dollar market cap. They grow into companies that define an industry and create jobs. Not all start ups want to go in that direction – some will opt instead to become a small business. There’s nothing wrong with a business that supports you and perhaps an extended family. But if you want to build a scalable startup you need to be asking how you can you get enough customers/users/payers to build a business that can grow revenues past several $100M/year. […]

Fantastic definition of the different types of start-ups here! The distinction you make between a scalable start-up and a small-scale “large company” is something that should be taught more frequently to business students – it’s a surprisingly common misconception and you’ve nailed the best definition of it.