For its first few decades Silicon Valley was content flying under the radar of Washington politics. It wasn’t until Fairchild and Intel were almost bankrupted by Japanese semiconductor manufacturers in the early 1980’s that they formed Silicon Valley’s first lobbying group. Microsoft did not open a Washington office until 1995.

Fast forward to today. The words “startup,” “entrepreneur,” and “innovation” are used fast, loose and furious by both parties in Washington. Last week the White House announced Startup America, a public/private initiative to accelerate accelerate high-growth entrepreneurship in the U.S. by expanding startups access to capital (with two $1 billion programs); creating a national network of entrepreneurship education, commercializing federally-funded research and development programs and getting rid of tax and paperwork barriers for startups.

What’s not to like?

My observation. Startup America is a mashup of very smart programs by very smart people but not a strategy. It made for a great photo op, press announcement and impassioned speeches. (Heck, who wouldn’t go to the White House if the President called.) It engaged the best and the brightest who all bring enormous energy and talent to offer the country. The technorati were effusive in their praise.

I hope it succeeds. But I predict despite all of Washingtons’ good intentions, it’s dead on arrival.

Dead On Arrival

I got a call from a recruiter looking for a CEO for the Startup America Partnership. Looking at the job spec reminded me what it would be like to lead the official rules committee for the Union of Anarchists.

There are three problems. First, an entrepreneurship initiative needs to be an integral part of both a coherent economic policy and a national innovation policy – one that creates jobs for Main Street versus Wall Street. It should address not only the creation of new jobs, but also the continued hemorrhaging of jobs and entire strategic industries offshore.

Second, trying to create Startup America without understanding and articulating the distinctions among the four types of entrepreneurship (described later) means we have no roadmap of where to place the bets on job growth, innovation, legislation and incentives.

Third, the notion of a public/private partnership without giving entrepreneurs a seat at the policy table inside the White House is like telling the passengers they can fly the plane from their seats. It has zero authority, budget or influence. It’s the national cheerleader for startups.

The Four Types of Entrepreneurship

“Startup,” “entrepreneur,” and “innovation” now means everything to everyone. Which means in the end they mean nothing. There doesn’t seem to be a coherent policy distinction between small business startups, scalable startups, corporations dealing with disruptive innovation and social entrepreneurs. The words “startup,” “entrepreneur,” and “innovation” mean different things in Silicon Valley, Main Street, Corporate America and Non Profits. Unless the people who actually make policy (rather than the great people who advise them) understand the difference, and can communicate them clearly, the chance of any of the Startup America policies having a substantive effect on innovation, jobs or the gross domestic product is low.

1. Small Business Entrepreneurship

Today, the overwhelming number of entrepreneurs and startups in the United States are still small businesses. There are 5.7 million small businesses in the U.S. They make up 99.7% of all companies and employ 50% of all non-governmental workers.

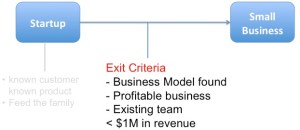

Small businesses are grocery stores, hairdressers, consultants, travel agents, internet commerce storefronts, carpenters, plumbers, electricians, etc. They are anyone who runs his/her own business. They hire local employees or family. Most are barely profitable. Their definition of success is to feed the family and make a profit, not to take over an industry or build a $100 million business. As they can’t provide the scale to attract venture capital, they fund their businesses via friends/family or small business loans.

2. Scalable Startup Entrepreneurship

Unlike small businesses, scalable startups are what Silicon Valley entrepreneurs and their venture investors do. These entrepreneurs start a company knowing from day one that their vision could change the world. They attract investment from equally crazy financial investors – venture capitalists. They hire the best and the brightest. Their job is to search for a repeatable and scalable business model. When they find it, their focus on scale requires even more venture capital to fuel rapid expansion.

Scalable startups in innovation clusters (Silicon Valley, Shanghai, New York, Bangalore, Israel, etc.) make up a small percentage of entrepreneurs and startups but because of the outsize returns, attract almost all the risk capital (and press.) Startup America was focussed on this segment of startups.

3. Large Company Entrepreneurship

3. Large Company Entrepreneurship

Large companies have finite life cycles. Most grow through sustaining innovation, offering new products that are variants around their core products. Changes in customer tastes, new technologies, legislation, new competitors, etc. can create pressure for more disruptive innovation – requiring large companies to create entirely new products sold into new customers in new markets. Existing companies do this by either acquiring innovative companies or attempting to build a disruptive product inside. Ironically, large company size and culture make disruptive innovation extremely difficult to execute.

4. Social Entrepreneurship

4. Social Entrepreneurship

Social entrepreneurs are innovators who focus on creating products and services that solve social needs and problems. But unlike scalable startups their goal is to make the world a better place, not to take market share or to create to wealth for the founders. They may be nonprofit, for-profit, or hybrid.

So What?

Each of these four very different business segments require very different educational tools, economic incentives (tax breaks, paperwork/regulation reduction, incentives), etc. Yet as different as they are, understanding them together is what makes the difference between a jobs and innovation strategy and a disconnected set of tactics.

Go take a look at any of the government organizations talking about entrepreneurship and see how many of its leaders or staff actually started a company or a venture firm. Or had to make a payroll with no money in the bank. We’re trying to kick-start a national initiative on startups, entrepreneurs and innovation with academics, economists and large company executives. Great for policy papers, but probably not optimal for making change.

Rather than having our best and the brightest visit for a day, what we need sitting in the White House (and on both sides of the aisle in Congress) are people who actually have started, built and grown companies and/or venture firms. (If we’re serious about this stuff we should have some headcount equivalence to the influence bankers have.)

Next time the talent shows up for a Startup America initiative, they ought to be getting offices not sound bites.

Lessons Learned

- Lots of credit in trying to “talk-the-talk” of startups

- No evidence that Washington yet understands the types of entrepreneurs and startups; how they differ, and how they can form a cohesive and integrated jobs and innovation strategy

- Not much will happen until entrepreneurs and VC’s have a seat at the table

Listen to the post here: Download the Podcast here

Filed under: Technology, Venture Capital |

Thanks Steve, I was looking forward to your take on Startup America and after studying the history of Silicon Valley it was clear the effort would have major challenges is executing its stated goals.

My earlier reaction focused on the differences between what government is best at, and what entrepreneurs are best at. Direct support of startups is folly for legislators unless it’s intended goal is minimizing friction. A better funnel for investment are in big R&D projects that private companies can’t do on their own.

A quote from another related post:

“President John F. Kennedy didn’t pitch building better rockets to the American people by showing them a handful of designs, he authoritatively addressed congress in 1961 declaring a national goal of “landing a man on the Moon”.”

Spot on

I hope others do as I plan to follow up to Congress with all the points you make.

I respect Steve Case, but SUA has David Plouffe

theatre written all over it.

” It made for a great photo op, press announcement and impassioned speeches”

Remember, Obama’s difficult reelection campaign starts before long.

If they give SUA a year to see if it has any real traction, just enough to spin, or needs to put in the closet, we’re within the 2012 run up to November 6.

Maybe I’m cynical, but I’ve never seen an admin more about the window dressing, more “all hat”, than this one.

or enough to spin

Very well stated.

I felt the program is too tech-focused because that’s considered sexy, but it doesn’t solve the problem of urban poverty, or unemployment among factory workers, or revitalization of downtowns.

There’s a barber school in downtown Lancaster, PA called Champ’s; Lancaster has a mixed population with about a 25% poverty rate and maybe 15% unemployment (including off book).

Within a year after Champ’s opening, barber shops started springing up on every other corner. Someone commented to me “there must be a lot of people who want to be barbers”.

I suspected not, so I asked Champ. “They want to make their own breaks.” They’re tired of waiting for something else to happen and owning a barber shop is better than working at McD’s.

We talk about entrepreneurship as though it’s the domain for the young and well-educated. But if you want life-changing impact, invest in people who aren’t necessarily well educated, but they’re committed and driven.

Those same guys opening barber shops can’t get loans or training for anything else. And society has largely written them off. So they take the paths open to them.

Finally, we absolutely need to do something about China’s illegal trade behavior and US companies that continue to benefit from it at the expense of factory workers and local govt revenues here.

the post from “admin” was from me. Not sure why wordpress is doing that…

That sounded like you, Charlie. And Lancaster was a give away.

Glad to see you spreading the wisdom.

Hi Steve,

Your post is excellent. Furthermore, you have just highlighted the chasm between the Europe and America on this subject. I only wish there were some similar government initiatives in this part of the world. I think Europe has a long way to go before we can even begin to think about having the type of debate you are engaging in. Keep up the good work. Trevor

Steve,

I like the framework you are suggesting. Would you take on the office if given the opportunity?

I completely agree that we need proven entrepreneur leaders up there to make real change. I also believe that if ask and directed in the right manner, most entrepreneurs would standup for this cause.

If we all have the chance to make Startup America better – we can and we should. We all stand to benefit and I’m willing to help.

What do others think?

I was thinking about this the other day and couldn’t agree with you more. I see small businesses calling themselves “startups” all the time. The basic issue is that the government cannot give resources to 100% of the new businesses created in the United States. Instead they should be focusing on identifying the 20% of high growth, high scale startups that will provide a large amount of jobs in proportion to the investment made.

Steve,

First, let me say that I think (yet another) government program is the last thing we need. The government historically misallocates capital and uses it for economically innefficient activities.

However, I am greatly comforted by that fact that TechStars, and the people who founded it, are on board with this. While I do think that TechStars would still do what it is doing as part of the initiative or not, their work deserves promotion. It acts as an example for what communities can do when people take responsibility for their own town.

Finally, you mentioned VCs and entrepreneurs need a seat at the table. I would also state that existing small businesses need a seat as well. While “starting up” is important, cultivating existing business is equally important.

I’m connected to Steve Case on Facebook and I’ve been reading a lot about his well-intentioned participation in this. And he is arguably a true American entrepreneurial success story. However, I’ve independently come to the same conclusion as you. Whenever the government gets involved it adds another costly layer of bureaucracy that virtually always impedes innovation and change.

IMHO the easiest and fastest way that the government could spur entrepreneurial activity is to suspend the capital gains tax for 24 months for any investments made in *new* businesses: watch how money would flow into the economy if that occurred.

Bill Ross

bill at latrobellum dot com

http://www.latrobellum.com

Bill, in terms of capital gains tax, maybe you have something broader in mind, but I just attended a briefing where we were told that permanent elimination of capital gains tax for QSB stock will be part of the administration’s 2012 budget, and that this one piece in particular is a major goal of the government policy side of the Startup America initiative.

Mr. Carleton,

I guess that means I’m a visionary as I’ve been harping about that for the past 3 years… 😉

In all seriousness however, government involvement in entrepreneurship would best be served by minimizing bureaucracy, and encouraging new businesses through tax breaks in investments, tax breaks in education, and tax credits for risk-taking.

Regards,

Bill Ross

@ThruTheNoise

The details of how the Startup America initiative evolves into a national innovation strategy are yet unclear. It’s a work in progress.

The first steps, the speeches & photo-ops, are meant to mobilize the naysayers. Jobs creation needs an infusion of focused national attention. What we have is a laudable start.

Perhaps the administration should consult with you to evolve and shape the policy. I’d be interested in more specifics on how you’d shape it if it was your policy (e.g., The Blank Startup America Initiative).

Thanks.

We agree with some of your opinions. But fortunately, the future for small business and entrepanuers does not lie in the hands of Washington or the Crooked CEOs.

China has come to our rescue with $ 1 Billion to take our products wordwide.

Spread the word to other small businesses with something to offer!

Further, such government programs do massive economic damage. To spend that $2B will probably take $4-6B in overhead, but even if they could do it for free, that $2B would destroy many more jobs than this program has a hope of creating. Further, the jobs it will create, by definition are in politically correct industries, where a subsidy is what makes the company viable (eg: “clean energy” and “economically disadvantaged regions”, specifically named targets in the announcement.).

Giving money to politicians to hand out to cronies is not how you grow an economy.

A much better way to spend money to boost employment and startups would be to simply reduce corporate or personal income taxes (don’t care which).

If they want to foster innovation, start dismantling the infrastructure they’ve grown to strangle it. From the FDA to the DEA to NASA, private industry is prevented from moving forward by having to ask permission of burocrats who, inevitably have their hand out.

The economy is doing poorly because it is run based on pull, rather than innovation.

While we’re at it, lets recognize that it was clintons “failing to lend money to people who can’t pay it back is racist” regulatory “reforms” against banks, combined with Greenspan (under clinton and bush) and later Bernanke keeping interest rates below the rate of inflation, essentially gasoline to a credit based bonfire.

I know it is popular to blame the banks, but that’s because it is popular to take self serving politicans at their word.

This “program” is so out of step with economic reality that it is proof positive that the administration and the ploticians behind it either are incompetant and profoundly ignorant or economics, or couldn’t care less about the state of the economy… either way, they should not have the level of power over it that they do.

In my previous comment I was typing too fast and glossed over an important point– the $2B destroys jobs because it has to come out of the economy in the first place. It has to come from somewhere. If from taxes it comes out of personal and corporate bottom lines, stifling spending or expansion that leads to job growth. If it comes out of inflation (they just print it) then it does exactly the same thing because it drives up the prices of everything else in the economy.

TANSTAAFL. Any government spending to attempt to “stimulate” or help the economy is more damaging to the economy than beneficial. Because it comes from the most sensitive part of the job creation cycle, and because it will mostly go to politically connected individuals, rather than the places the market would direct it for maximum economic growth.

Really this is just a big example of the Broken Window Fallacy… and if we are pro-startups we should simply oppose these programs outright.

We don’t need a BS PR stunt like this whose sole purpose is to redistribute some wealth to cronies and make for a pretend “initiative” to talk about in the state of the union…. we need basic reform of government.

Government is the entirety of our economic problems. It has no interest in fixing it, on the contrary, its interest is in destroying the economy (and profiting from the demise.)

Steve,

Great observations and comments. I would also add that those who have not been “in the trenches” within the last few (3 to 5) years or those who focus exclusively on universities as a source may not be the best “leaders” for this effort. I have been impressed by the smattering of entreprenuers within the administration but they are too few and too deep to have the impact that is needed.

Hear hear

The best thing the government can do is get the f**k out of the way after enacting immigration policy reform with respect to H1-B visas, enact responsible tax policy and perhaps create from ‘enterprise zones’ in depressed areas where entrepreneurs get special breaks for starting companies and hiring new employees. Synfuels didn’t work and Sematech didn’t work either. Startup America will be yet another egregious waste of money.

Wrong! De-Regulation is what has caused the problem. Strong regulation is needed to create a “free market” which no longer eixsts in America.

A “free market” is actually a very regulated, fair equal playing field of easy laws to follow where a single individual can compete with a large multi-national on whomever has the best products and services.

“Free markets” no longer exist in America. Large mult-nationals, through de-regulation have destroyed compeition.

The US is very highly regulated, and these regulations have caused things like the california energy criss, the banking crises right now (regulated top to bottom since 1913, and also a result of the “lend to people who can’t pay or else” regulation). etc.

No matter how much their policies fail, or how many people die or otherwise suffer, socialists will claim that it is lack of socialism that caused the problem and prescribe more socialism.

200million people were murdered by socialist governments between 1900-2000.

A free market is one where people are free to associate and trade with each other on terms mutually beneficial to them. You call it “Fair” when YOU get to dictate the terms they trade under, even if both of them would rather trade under other terms.

Sorry, buddy, we’re not your slaves. A free market doesn’t exist, because people like you have managed to hamstring us with regulations… causing the economic depression we find ourselves in.

Sorry! But the California energy problem was a direct result of California DEregulation that allowed Enron to manipulate the energy market. California continues to lead the nation in per-capita energy efficiency.

At least pretend to get your facts right.

Peter, your comment is really interesting, because you listed 3 concrete, VERY important public policies that require government to do a good job and to get it right! IMHO we should demand of our government, not to get out of the way or abdicate responsibility, but to stick to the issues we need them to address, get the answers right, and be accountable.

What I need is goverment to make small business more competitive – equal playing field with massive wall stree backed firms.

* Cost of health care – most large firms have drastically lower health care costs than small business, so difficult to hire talent.

* Cost of captial – not access to it. Large firms with partner wall street banks can borrow at 0% from the treasury – I cannot get close to that.

* Cost of Legal – I cannot fight with a large firm, thier legal will put me out of business through years of US legal system pain.

Steve; so right about DC but so what! If they have money they asssume they can make a difference. Fed money is spent by feds according to fed laws which are not the same rules (I hope) used by VC or entrepeneurs. Don’t complain about the obvious limitations of the biggest corporation in the world… Steve tell them what to do. What % of OUR money to each of the 4 types and why. One important point might be that VC’s are already betting on scaleable starups so % to that category from FED should be minimal. Now for the hard part how much for the other 3 and why?

Steve,

I was hoping that you’d talk about this. And not surprised that you’ve done so, so incisively and insightfully. Thank you. We need your voice.

I like the idea of Startup America, but it feels like a game.

A lot of respect for Steve Case and Carl Schramm and, well, the value of Brad Feld’s input as an advisor goes without saying. Maybe there’s hope.

Glad that the White House is at least paying attention to startups (but how could they not — especially with an election year coming up?).

Yet government and entrepreneurship — oil and water? Oxymoronic?

What gives me hope is that, in the end, those who are true entrepreneurs and those who love them and/or fund them will find a way to use this to advantage. They know what to do with opportunity and resources. The dog won’t be wagged by the tail.

Perhaps, Startup America will even face a bit of disruption. That would be cool.

You need to contact Jered Polis the rep from Colorado.

http://polis.house.gov/

He fits your description of a successful entrepreneur now in the house. He has done a lot of work on the startup visa bill to keep smart people coming to the US.

The is NOT a shortage of Capital for small business.

There is a compelte LACK OF REGULATION due to 20 years of “de-regulation” which destroyed competition and free markets for the advantage of large multi-nationals over small business.

If you cannot get BIG FAST, then you cannot compete.

1. Communist labor. Labor laws in America have been crush and wages continue to decline. The HURTS real American business NOT helps. It only helps multinationals and those the run sweat shops.

Henry Ford paid a fair wage so his emploees were happy, could raise family, and purchase the products they produced themselves.

Labor + Capital = Capitalism. You destroy labor then you destroy a functioning economy.

America needs labor laws to stop offshoring and to allow small business to compete with large multi-nations that constantly jump to the next communist slave labor country.

2. Cost of Captial. The Wall Street banks have captured the Federal Reserve and US Treasury and so can print public money without approval of congress. Large fims willing to sell out to walls street thus have UNLIMITED FREE PUBLIC MONEY to exapand and crush any small business compeition that must borrow benefits and market interest rates.

3. Health Insurance Regulation. There is NO free market for health insurance in America so large firms have a MASSIVE COST ADVANTAGE. large firms are filled with talented, underproductive employees there only to get HEALTH INSURANCE. Small Business cannot compete and cannot attrack this talent so must hire kids out of college or immigratnts with degrees.

Government health care IS GOOD FOR SMALL BUSINESS in America and good for economic growth. It is bad for heatlh insurance financial monopoly and large mult-national firms that partner with this health insurance financial firms.

The list can go on and on….the theme is always the same….

American small business only needs a “Free Market” and the rest will take care of itselft. A free market is a highly regulated, fair and enforceable laws so that small business can compete on quality and delivery of products and services against large mult-nationals, wall street bankers, and communist slave labor.

Hi Steve,

Good point on being more clear about the different types of entrepreneurs.

I do think you’re being harsh on the initiative though. I’m a co-founder of an entrepreneurship education support organization, Extreme Entrepreneurship Tour (http://www.extremetour.org/), and have been helping with the initiative over the past few months, and was at the White House event.

Here are the positive things I’ve seen so far:

1. They’re inclusively reaching out to all the organizations in the entrepreneurship education/support field and bringing them together for the first time.

2. They’re spinning out the Startup America Partnership into its own 501c3 and having it funded by the Case Foundation and Kauffman Foundation.

3. They’re promoting the power of entrepreneurship in the media as a solution to unemployment, which is extremely helpful to our field.

4. They are very open to feedback.

5. They are involving entrepeneurs. Carl Schramm and Steve Case were both entrepreneurs in their past lives, and they’re the founding organizations/directors of the new Startup America Partnership. My main point of contact and one of the main people on the ground has been an entrepreneur for the past 10 years

6. They’re promoting the importance of entrepreneurship within the government. From the entrepreneurship education perspective, I think this is critical. One of the reasons that entrepreneurship isn’t taught in all high schools across America is the current focus on reading, writing, and math to the exclusion of fields like entrepreneurship. If policy could be changed to make it easier for high schools to teach entrepreneurship, millions more could be exposed to it.

I don’t have as much familiarity on things from a policy perspective, but overall I would say that initiative is definitely in the right direction for our field.

Good post! In the long run it is a matter of greasing the wheel for pork. Both parties will play and the same ol’ reward for mediocrity prevails.

You make a great point that government will be hard pressed to develop policy to kick-start startup innovation when those in charge have not traveled the path of the entrepreneur.

I enjoyed the re-emphasis on the four types of entrepreneurship!

If I didn’t know how happy you are doing what you are doing, I would have begged for you to take the recuriter’s offer for the job. You’ve got the perfect mix of startup and 3 letter agency experience.

[…] via Startup America – Dead On Arrival « Steve Blank. […]

Steve, kudo’s for pointing out the differences between the different types of startups/entrepreneurs. I think that in silicon valley and other innovation clusters, we tend to be pretty arrogant about the important of venture-backed technology startups and are unaware of the importance of “regular” small business startups (e.g., grocers) to our economy. There’s only going to be so many game-changing startups every year and so many jobs created by them, while there will be orders of magnitudes more “regular” small companies trying to create value and jobs within their community.

I am disappointed but not surprised by the knee-jerk “anti-government” reaction of some commentators here. It’s more obvious to me than ever that our current implementation of Capitalism is very flawed (e.g., lack of transparency creates market disparities and inefficiencies) and we need a regulator to try to ensure that the pre-requisites for a healthy free-market economy are in place. Further, the assumption that any government program will by definition hurt more than it helps reveals a dangerous bias; we should be asking how to help our government do better rather than assuming it is doomed for failure.

“Further, the assumption that any government program will by definition hurt more than it helps reveals a dangerous bias; we should be asking how to help our government do better rather than assuming it is doomed for failure.”

Some smart well intentioned Romans surely said the same, and tried their best to save their empire, but their efforts were for naught. The empire is too big to change, too corrupt to prosper, and too near the end for hope.

Get yours and get out!

[…] Startup America – Dead On Arrival For its first few decades Silicon Valley was content flying under the radar of Washington politics. It wasn’t until […] […]

LESSON LEARNED:

Let’s focus on solutions that create value for the market (individuals like you and me). If the government comes up with something that works, it’s a bonus. If not, we’ve not put our eggs in one basket. Freedom to try, to succeed, and to “fail” are the foundation of a thriving economy. The “odds” are in favor of free markets not legislative mandates.

Steve, thanks for

I think what Steve Case, Brad Feld and TechStars are doing at Startup America is a great idea but seems to be focused on younger, college educated, tech focused individuals.

I would like to see them to reach out to recently separated veterans who have the capability to start a business.

Vets can start business in all four areas but they will most likely have the most impact in small and scalable startup businesses

I think Steve Blank (Air Force Vet) has done a pretty good job in the Valley.

Military veterans have a long track record of project management, people skills and access to a government guaranteed loans up to $125K.

Transitioning Veterans bring the following to the civilian business market:

Proven Leadership and Decisiveness: Many vets have led and managed groups of people ranging in size from 13-150 before the age of 28. I would take that asset over the Ivy League educated, management consultant who can make an awesome PowerPoint deck but can’t decide between a Tall and Grande Mocha at Starbucks

Professionalism: We will use adult language and decent attire when presenting to investors.

Elevated Sense of Responsibility:Military personnel know how to make decisions and take responsibility to meet a deadline. If the deadline can’t be met you are informed and a alternate course of action is proposed. A sense of urgency is always apparent.

Mission Critical Skills: As an alum of the most technologically advanced entity in the world, a large majority of vets can leave the military and walk right into a comparable civilian sector job. As military veterans they have learned that best plans go up in smoke at the first volley of fire and they are able to use their flexibilty to adapt their previous knowledge as a strong foundation for newly required skills.

Grace Under Pressure: A military vet knows how to handle stress, both off and on the job.

Undeniable “Can Do” Attitude: Military vets always project a positive attitude. They assume any task can be done and will move mountains to make it happen. Vets have been given many planning tools to map out a way forward. (Some are fairly similar to PMI standards)

Possess A Global Perspective: If a veteran has been the military longer than 12 months then chances are, that individual has had to interact with a culture of people dynamically different than their own. Most Americans have not had this opportunity and even the superstars at Fortune 500 firms often fail at overseas assignments.

My recent experience with a Dallas based mentorship-driven microseed fund and startup accelerator was mostly positive. After pitching at Dallas Startup Weekend in November, ( we were known as Log Dog Jobs then )we were invited for an initial pitch to a Managing Partner of the fund. After this screening we were encouraged to apply for the spring class of the program. Per the reputable guidance of the previously mentioned partner, we made a pivot in the business model which allowed us to be selected as a semi-finalist. We then pitched last week at their Quick Pitch Day. But then we were cut fairly quickly with only vague feedback received. (Too early and not a big enough market we were told)

I think bringing us on for the three months would have made sense. Hello I’m could have taken a VA loan out or used our GI Bill benefits (If a Masters Certificate was offered with a university in town) to work on the idea while learning from our peers and mentors (code for investors) with no financial risk to the program.

Supporting Vets is more than hanging a “Support Our Troops” sign in the window or on a bumper sticker.

Vets are not asking for hand outs, we just need tangible assistance in the form of a transfer of knowledge. We will take care of the rest.

Blog Framwork/Reference Used: The Business Case For Hiring Vets Susan Brunell

Originally posted: on Hello I’m Logistics dot com

I don’t understand. Why wouldn’t a group of academics, politicians, and lawyers know how best to tell other people how to successful start a business. That model has worked very well for this country for the past 20 years.

I know that I am looking to hire the smartest people in world for my business and they all are in DC, right? I mean, they are all able to get very rich without doing anything of economic value so they must be smarter than me!

A better idea than this VC-focused boondoogle is expanding funding to SCORE ( http://www.score.org )

BTW for the opposite rah-rah POV: http://www.feld.com/wp/archives/2011/02/startup-america-partnership.html

Additional point, Brad Feld does NOT understand SMB.

Look at this post ( http://www.feld.com/wp/archives/2011/01/calling-all-boulder-tech-companies-to-engage-with-downtown-boulder-inc.html ). Brad does not understand why a retail operation would want internet sales to be taxed the same as a local business is taxed.

If he can’t even get inside the mindset of a retailer to understand their position, he can’t understand them well enough to advise them.

I agree. DOA. They should have people who have run McDonalds Franchisees or started their own 4 store business – not Brad. He only knows non-lifestyle businesses.

4 years ago, myself and two of my colleagues from graduate school were handed a big chunk of money from the SBIR program, one of the mechanisms the government uses to commercialize federally funded research. The grant expires 60 days from now, and so does our company, because the funding mechanism forces you stay inside the building and follow a set development plan. It also encourages you to run a small company like a big one (the government uses the same set of accounting rules for a 2 man software shop as it does for Lockheed Martin) Additionally, the agency that funds us also funds several academic software projects that compete with our software, essentially nullifying the commercial potential of our work.

So, yeah, after four years of living inside of government-sponsored entrepreneurship, I’m a bit cynical about what the government can really do.

Ronald Reagan once said that government’s view of business was: “If it moves, tax it. If it keeps moving, regulate it. If it stops moving, subsidize it.”

“Startup America” is in the “subsidization phase”.

Which brings another Reagan quote to mind:

“The nearest thing to eternal life we will ever see on this earth is a government program.”

Is there not a category missing in between “small business” and “scalable startup”? That is, profitable businesses that are not necessarily or even intending to be “change the world” businesses?

I had to laugh when I read about this program

Bureaucrats in charge of entrepreneurs, yeah that will work!

Nice post

[…] STARTUP AMERICA WILL FAIL Steve Blank says the recently announced Startup America program is dead on arrival: “Startup America is a mashup of very smart programs by very smart people but not a strategy. It […]

For the record, this “Start Up America” is a “public/private partnership”, which is literally a euphemism for “fascism.”

Hi Steve,

I can’t find how to contact you except through a reply. I apologize that it is not specific to your post.

But I am sure you will be interested….

In short, we are a startup launching a service ….

[…] entrepreneurship. Steve Blank did a nice job articulating four types of startups in his scathing post about Startup […]

[…] entrepreneurship. Steve Blank did a nice job articulating four types of startups in his scathing post about Startup […]

Hi Steve, I have waited 9 months for this reply, until my book, Launch America! Reviving the American Dream was finally complete. Using private capital to fund all types of startps across this country, not just high-growth startups, is what will create a positive momentum and jobs for Americans in all walks of life.

We have presented in the book the Luanch America Initiative and have proposed it to the administration. The Initiative would create a major tax incentive and safety net, in the form of a tax credit to all investors in all types of startups. We are also working to provide the best practice guidelines to the entrepreneurs and help them form a team, write a compelling business plan and get the funding they need thorugh our new site, StartupTeamup.com. Funding hundreds of thousands of all types of startups, that emply just a few people each, will have a positive and uplifting effect on the economy and the American people.

I would like to ask you to assist us with our project and the online education program for the men and women across America who have a dream and are passionate about starting their businesses. I look forward to hearing from you.

Best regards,

Nick Bassill

Founder

Launch America.org